Calculate pay rate from salary

For the hourly rate you will use the same procedure to calculate your pay rise. This calculator does not calculate monthly salary based on a 4 week month.

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Bookkeeping Templates

What is the formula to calculate overtime pay.

. For many finding their hourly pay rate is as simple as looking at a recent pay stub. To calculate your total salary obtain your taxable wages from either Box 3 or Box 5 and add the amount to your nontaxable wages and pretax deductions which are excluded from FICA taxes. You must be equipped with the compensation data of your business ie the salary ranges and information to determine the minimum midpoint and maximum point of every designation.

Examples of Calculating Inflation. For instance for Hourly Rate 2600 the Premium Rate at Double Time 2600 X 2 5200. Gross Pay Annual Salary Amount Number of Pay Periods.

This means that the hourly rate for the average UK salary is 1504 per hour. If Joe bought his morning coffee for 125 in 2010 but now hes paying 160 in 2020 he can use this formula to calculate the inflation rate. The standard gross pay calculation is.

He currently makes a gross annual salary of 50000. So Monthly salary basic pay grade pay DA 15600 540025000 Rs. Get a Credit Card that matches your Grade Pay Check Pre-approved Offers and Apply Instantly.

Then add any additional income theyve earned that pay period including overtime pay commissions bonuses etc. Under federal law to calculate a nonexempt employees regular rate of pay divide the weekly salary by the total number of hours worked. 160 minus 125 equals 035.

Divide the employees annual salary by the number of pay periods. FICA Tax 3825. The total working days in a year TWD may vary from one employee to another.

To answer many of these questions you will need to know how to calculate wages from rates to salaries for various different time frames. According to the FLSA the formula for calculating overtime pay is the nonexempt employees regular rate of pay x 15 x overtime hours worked. Salary deduction for unauthorised absence from work.

VIP will calculate a rate per day based on any income flagged as variable BCEA remuneration An employee who has no variable income will not receive any BCEA Leave Pay as this employee will receive a full salary. The 16 Essential HR Documents Every Human Resources Department Needs. However since theyre compensated hourly youll first have to calculate annual salary.

If an employee regularly works from Mondays to Saturdays his expected TWD in a year is 313 days. 19 for every 1 over 18200. Bill is an electrician who wants to calculate his take-home net pay.

Salary in lieu of annual leave. For the purposes of deduction of tax on salary payable in foreign currency the value in rupees of such salary shall be calculated at the Telegraphic transfer buying rate of such currency as on the date on which tax is required to be deducted at source see Rule 26. In the event of a conflict between the information from the Pay Rate Calculator.

Theres more to pay than just using a pay raise calculator. Under the FLSA the regular rate includes all remuneration for employment paid to or on behalf of the employee The FLSA 29 USC 207e provides an exhaustive list of types of payments that can be excluded from the regular rate of pay when calculating overtime compensation. This guide will help you convert bi-weekly pay to an annual salary.

To earn a gross pay of 10000month an employee makes 120000 annually and receives 12 paychecks. Salary Compa-ratio Actual Salary Salary Midpoint 100. To calculate an hourly employees gross wages for a pay period multiply their hourly pay rate by their number of hours worked.

What Are the Differences. Use this tool to calculate how long it will take to repay your loan. For premium rate Double Time multiply your hourly rate by 2.

Some people define a month as 4 weeks. Salary Paid in Foreign Currency. Heres how a salaried.

An employee received a pay raise of 115 an hour by the owner but the owner forgot to inform the payroll department. For example if their hourly rate is 30 and they work 40 hours a week their annual wages would be 52000. Employers pay their employees based on either an hourly rate of pay or an annual salary.

This would be 0429 x 100 429 which is a 1429 increase to your hourly wage. The two primary methods of compensation each have pros and cons and some people prefer one method of pay over the. Total Variable remuneration rate factor 176822.

To calculate your take-home pay follow these steps. 60163 per week 366 hours per week 1504 per hour. How to calculate take-home pay.

Such pretax deductions include Section 125 cafeteria plans that include health and accident insurance and dependent care and health savings accounts. Gross pay per check decreases with additional pay periods. You subtract the present rate from whatever your gross income is for the year.

CO State Tax 1915. Exclusions from the regular rate. Do this by multiplying their hourly rate by the number of weeks 52 in a year and the number of hours worked per week usually 40.

Bill lives in Colorado with his wife and daughter. Easily convert hourly wage or pay rate to salary. Salary in lieu of notice of termination of service.

To calculate basic rate of pay for 1 day you can use formula as follow. Hourly Salaries Toggle. Steps to Calculate the Salary Compa-ratio.

The employee will need the difference paid as retro pay for the 40 hours in the prior period back to the date the raise. However if youre a salaried employee or are self-employed calculating your hourly wage takes a few steps. Begin by obtaining the salary details all of it.

What about additional Benefits. This calculator assumes a work week consists of 40 hours and a work day. Calculating the gross pay for salaried employees is simple.

Employers must pay the regular rate of pay as calculated for overtime purposes when paying premium pay for missed meal and rest breaks. Knowing how to calculate and measure earnings will help you make comparisons to previous earnings and assist in making financial decisions. You can calculate your hourly rate based on.

As we previously reported the California Supreme Court in Ferra v. For Gross rate of pay its use to calculate. Payroll runs the employees last paycheck using the old pay rate to calculate earnings.

Formula For Gross Rate Salary Calculator Singapore. The Pay Rate Calculator is not a substitute for pay calculations in the Payroll Management System. Federal Income Tax 4233.

Basic Monthly Salary x 12 Total Working Days in a Year DAILY RATE Important. Visit to see yearly monthly weekly and daily pay tables and graphs. Here are five issues employers must be aware of regarding calculating an employees regular rate of pay.

According to data from Statista the average salary in the UK is 31285Assuming they work 40 hours per week their hourly rate would be as follows. Apart from a better basic salary you should also factor in all the additional benefits. If you work in human resources you will need to be ready to answer a variety of questions regarding paychecks.

Input your current loan amount as it. See how a change in your salary affects your pay.

Payroll Calculator Template Free Payroll Template Payroll Business Template

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

What Is Annual Income How To Calculate Your Salary

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Salary

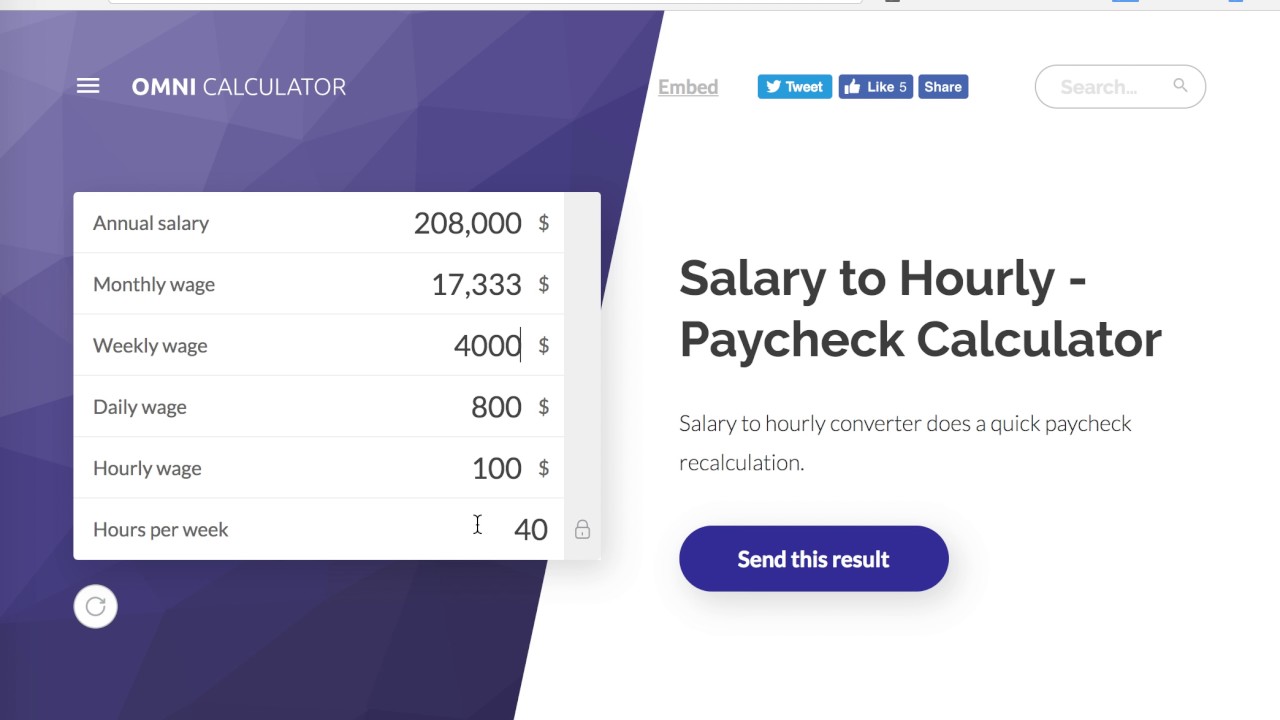

Salary To Hourly Salary Converter Omni Salary Paycheck Finance

Use Our Oregon Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Accoun Paycheck Salary Oregon

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Download Total Compensation Spend Rate Calculator Excel Template Exceldatapro Payroll Template Compensation Calculator

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Time Management Worksheet

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Calculator Templates

Calculate My Tips Track Your Hourly Rate And Salary Income And Wages Ios Store Store Top Apps App Annie App Iphone Apps Tips

Salary Calculator Template Google Docs Google Sheets Excel Apple Numbers Template Net Salary Calculator Salary Calculator

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Templates Excel Templates

How To Calculate Salary Increase Percentage In Excel Free Template Salary Increase Salary Salary Calculator

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Spreadsheet Template Life Planning Printables

Salary Increase Template Excel Compensation Metrics Calculations Salary Increase Business Budget Template Excel Budget Template

Salary To Hourly Calculator

Komentar

Posting Komentar